Corporate Governance

Based on Annual Report 2024

- Our Role

- Our Corporate Governance Framework and Culture

- Board Matters

- Remuneration Matters

- Accountability and Audit

- Stapled Securityholder Rights And Engagement

- Additional Information

- Code of Business Conduct

- Statement of Policies and Practices of CapitaLand Ascott Business Trust (CapitaLand Ascott BT)

CapitaLand Ascott Trust (CLAS) is a stapled group comprising CapitaLand Ascott Real Estate Investment Trust (CapitaLand Ascott REIT) and CapitaLand Ascott Business Trust (CapitaLand Ascott BT) pursuant to a stapling deed dated 9 September 2019 (as amended) and each stapled security consists of one CapitaLand Ascott REIT Unit and one CapitaLand Ascott BT Unit and is treated as a single instrument (Stapled Security).

CapitaLand Ascott Trust Management Limited (REIT Manager) was appointed manager of CapitaLand Ascott REIT in accordance with the terms of the trust deed dated 19 January 2006 (as amended) between the REIT Manager and DBS Trustee Limited, as the trustee of CapitaLand Ascott REIT (Trustee). CapitaLand Ascott Business Trust Management Pte. Ltd. (Trustee-Manager) (collectively with the REIT Manager, the Managers) was appointed the trustee-manager of CapitaLand Ascott BT in accordance with the terms of the trust deed constituting CapitaLand Ascott BT dated 9 September 2019 (as amended) (collectively, Trust Deeds)1.

We, as the Managers, set the strategic direction of CLAS and its subsidiaries (CLAS Group) and make recommendations to the Trustee on any investment or divestment opportunities for CLAS and the enhancement of the assets of CLAS in accordance with the stated investment strategy of CLAS. The research, evaluation and analysis required for this purpose are coordinated and carried out by us as the Managers.

As the Managers, we have general powers of management over the assets of CLAS. Our primary responsibility is to manage the assets and liabilities of CLAS for the benefit of the stapled securityholders of CLAS (Stapled Securityholders). We do this with a focus on generating rental income and enhancing asset value over time so as to maximise returns from the investments, and ultimately the distributions and total returns, to Stapled Securityholders.

Our other functions and responsibilities as the Managers include, but are not limited to:

- using our best endeavours to conduct CLAS’ business in a proper and efficient manner;

- preparing annual business plans for review by the directors of the Managers (Directors), including forecasts on revenue, net income, capital expenditure, explanations on major variances to previous years’ financial results, written commentaries on key issues and underlying assumptions on rental rates, operating expenses and any other relevant assumptions;

- ensuring compliance with relevant laws and regulations, including the Listing Manual of Singapore Exchange Securities Trading Limited (SGX-ST) (Listing Manual), the Code on Collective Investment Schemes (CIS Code) issued by the Monetary Authority of Singapore (MAS) (including Appendix 6 of the CIS Code (Property Funds Appendix)), the Business Trusts Act 2004 (BTA), the Business Trusts Regulations 2005 (BTR), the Securities and Futures Act 2001 (SFA), written directions, notices, codes and other guidelines that the MAS may issue from time to time, the tax rulings issued by the Inland Revenue Authority of Singapore on the taxation of CLAS and Stapled Securityholders, and the United Kingdom’s Alternative Investment Fund Managers Regulations 2013 (as amended) (AIFMR);

- attending to all regular communications with Stapled Securityholders; and

- supervising the property managers of CLAS which perform the day-to-day property management functions (including leasing, marketing, promotion, operations coordination and other property management activities) for CLAS’ properties.

The Managers also consider sustainability issues (including environmental and social factors) as part of our responsibilities. More detailed information on the Boards statement, sustainability frameworks, policies, practices and performances, climate-related disclosures, and stakeholder engagements are provided on CLAS’ website at www.capitalandascotttrust.com (Website) and in CLAS’ Sustainability Report 2024, which will be published in May 2025.

CLAS is externally managed by the Managers. The Managers appoint experienced and well qualified personnel to run their day-to-day operations.

The Managers were appointed in accordance with the terms of the Trust Deeds. The Trust Deeds outline certain circumstances under which the Managers can be removed. In the case of CapitaLand Ascott REIT, by resolution passed by a simple majority, and in the case of CapitaLand Ascott BT, by 75% of Stapled Securityholders present and voting at a meeting of Stapled Securityholders duly convened and held in accordance with the provisions of the Trust Deeds.

The Managers are wholly owned subsidiaries of CapitaLand Investment Limited (CLI) which holds a significant stapled securityholding interest in CLAS. CLI is a leading global real asset manager, with a vested interest in the long-term performance of CLAS. CLI’s significant stapled securityholding interest in CLAS demonstrates its commitment to CLAS and as a result, CLI’s interest is aligned with that of other Stapled Securityholders.

The Managers’ association with CLI and its subsidiaries (CLI Group) provides the following benefits, among other things, to CLAS:

- strategic pipelines of property assets through, amongst others, CLI’s access to the development capabilities of and pipeline investment opportunities from CapitaLand Group’s development arm;

- wider and better access to banking and capital markets on favourable terms;

- fund raising and treasury support; and

- access to a bench of experienced management talent.

Note:

1. Copies of the Trust Deeds for the time being in force will be available for inspection at the registered offices of the Managers during usual business hours. Prior appointment with the Managers is required. Please contact the Managers via email at ask-us@capitalandascotttrust.com.

The Managers embrace the tenets of sound corporate governance, including accountability, transparency and sustainability. We are committed to enhancing long-term stapled securityholder value with appropriate people, processes and structure to manage the business of the Managers and deliver CLAS’ long-term strategic objectives.

The Boards of Directors of the Managers (Boards) are responsible for setting the Managers’ corporate governance standards and policies which sets the tone at the top.

This Report sets out the corporate governance practices for the financial year ended 31 December 2024 (FY 2024), benchmarked against the Code of Corporate Governance (Code).

In FY 2024, the Managers have complied with the principles of corporate governance laid down by the Code and also, substantially, with the provisions underlying the principles of the Code. Where there are deviations from the provisions of the Code, appropriate explanations are provided in this Report. This Report also sets out additional policies and practices adopted by the Managers which are not provided in the Code.

In FY 2024, CLAS was conferred the top spot in the Singapore Governance and Transparency Index within the REITs and Business Trusts category for the fourth consecutive year, and in FY 2022, CLAS was named “Best Investor Relations – Gold” in the REITs and Business Trusts category at the Singapore Corporate Awards. CLAS has been included by the SGX-ST in the Fast Track Programme list. The scheme recognises listed companies with good governance standards and compliance practices, and accords prioritised clearance for selected corporate-action submissions.

Board Changes

As part of the Boards’ renewal process, Mr Tan Beng Hai, Bob and Mr Goh Soon Keat Kevin stepped down from the Boards with effect from 22 April 2024 and 1 January 2025 respectively while Mr Lui Chong Chee and Mr Yeo Chin Fu Ervin were appointed on 1 February 2024 and 1 January 2025 respectively. Mr Lui Chong Chee took over the role of the Chairman with effect from 22 April 2024, following the retirement of Mr Tan Beng Hai, Bob.

Directors who are appointed to the Boards from time to time either have prior experience as a director of an issuer listed on the SGX-ST or will undergo further training required under Rule 210(5)(a) of the Listing Manual. Mr Yeo Chin Fu Ervin, being a first-time director, is or will be undergoing the requisite training under Rule 210(5)(a) of the Listing Manual before 31 December 2025 (being one year from the date of his appointment to the Boards). As at the date of this Report, Mr Yeo Chin Fu Ervin will be attending all of the relevant modules under the Listed Entity Directors (LED) Programme conducted by the Singapore Institute of Directors. Arrangements have been made for Mr Yeo Chin Fu Ervin to attend training in order to meet the mandatory training requirements under Practice Note 2.3 of the Listing Manual, with the target date of completion being June 2025.

Board Matters

Principle 1: The Boards' Conduct of Affairs

Boards' Duties and Responsibilities

The Boards’ primary responsibility is to foster CLAS’ success so as to deliver sustainable value over the long term. The Boards oversee the Managers’ strategic direction, performance and affairs and provide guidance to the management team (Management), led by the Chief Executive Officer (CEO). The Boards work with Management to achieve CLAS’ objectives and Management is accountable to the Boards for its performance and the execution of CLAS’ strategy.

The Boards establish goals for Management and monitor the achievement of these goals. The Boards ensure that proper and effective controls are in place to assess and manage business risks and compliance with the Listing Manual, Property Funds Appendix, and other applicable laws and regulations.

Written Boards approval limits have been established, which are communicated to Management, setting out matters which require their approval, including written financial approval limits such as capital expenditure, investments, divestments and bank borrowings.

The Boards delegate authority for transactions below those limits to Board committees (Board Committees) and Management for operational efficiency.

Directors are fiduciaries and are obliged at all times to act objectively in CLAS’ best interests. This sets the tone at the top on the desired organisational culture and ensures proper accountability within the Managers. The Boards have adopted a Board Code of Business Conduct and Ethics which provides for every Director to adhere to the highest standards of ethical conduct and to avoid conflicts of interest. Each Director is required to disclose to the Boards his/her interests in CLAS’ transactions (or potential transactions), and any other potential conflicts of interest, recuse himself/herself from deliberations and abstain from voting on such transactions. In FY 2024, every Director complied with this policy, and such compliance has been recorded in the minutes of meeting or written resolutions.

Sustainability

The Managers place sustainability at the core of everything we do. We are committed to growing our business in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of the communities in which we have a presence. In keeping with this commitment, sustainability-related considerations are key aspects of the Boards’ strategic formulation.

At the board level, in recognition of the importance of sustainability as a business imperative and consistent with the principle that the Boards play an important role in considering and incorporating sustainability considerations as part of its strategy development, an important consideration is ensuring that Environmental, Social and Governance (ESG) risks and opportunities are holistically integrated into and form the Managers’ long-term strategy. This also sets the tone at the top to ensure the alignment of the Managers’ activities with its purpose and stakeholder interests.

The Boards and the Managers are committed to ensuring environmental and workplace health and safety for their stakeholders, including employees and customers. CapitaLand’s Environmental, Health and Safety Management System is audited by a third-party accredited certification body to ISO 14001 and ISO 45001 standards, internationally recognised standards for the environmental management of businesses and occupational health and safety management of businesses respectively. CLAS’ health and safety practices are also aligned with the Code of Practice on Chief Executives’ and Board of Directors’ Workplace Safety and Health Duties which was gazetted in October 2022. CapitaLand’s Environmental, Health and Safety policy is readily available to employees and to all suppliers, service providers and partners.

All the members of the Boards attended or will attend the sustainability training as prescribed by the SGXST. New Directors who are appointed to the Boards from time to time who have not undergone training on sustainability matters as prescribed by the SGX-ST will either have expertise in sustainability matters or will undergo further training required under Rule 720(7) of the Listing Manual. Arrangement has been made for Mr Yeo Chin Fu Ervin, who was appointed as Director in January 2025, to attend such mandatory sustainability training in the financial year ended 31 December 2025 (FY 2025).

More details of CLAS’ sustainability approach, environmental policies, anti-corruption efforts, training and development can be found in CLAS’ Sustainability Report 2024 which will be published in May 2025.

Directors' Development

The Nominating and Remuneration Committee (NRC) ensures that the Managers have a training framework to equip Directors with the necessary knowledge and skills to understand CLAS’ business and discharge their duties and responsibilities as Directors (including their roles as executive, non-executive and independent directors). Directors, including those who have no prior experience as a director of an issuer listed on the SGX-ST, will undergo training as prescribed by the SGX-ST on, for example, the roles and responsibilities of a director. The costs of training for all Directors are borne by the Managers. Mr Yeo Chin Fu Ervin, being a first-time director, will undergo training in the roles and responsibilities of a director of a listed issuer, as prescribed by the SGXST, the details of which are set out above in the Board Changes section on page 65 of this Report.

Each newly-appointed Director is provided with a letter of appointment and a Director’s Manual (containing a broad range of information relating to Directors’ roles and responsibilities and the Managers’ policies on disclosure of interests in securities, conflicts of interests and securities trading restrictions). All Directors undergo an induction programme which focuses on orientating the Director to CLAS’ business, operations, policies, strategies, and financial and governance practices, and includes visits to CLAS’ properties.

Directors are provided with opportunities for continuing education in areas such as director’s duties and responsibilities, laws and regulations, risk management and accounting standards, industry-related matters and sustainability so as to be updated on matters that enhance their performance as Directors or Board Committee members. Directors can also request for training in any other area or recommend specific training development programmes to the Boards2.

In FY 2024, the training and professional development programmes for the Directors included seminars and training sessions conducted by experts and senior business leaders on reinvention in the age of Gen AI and CapitaLand’s Perspective on Gen AI.

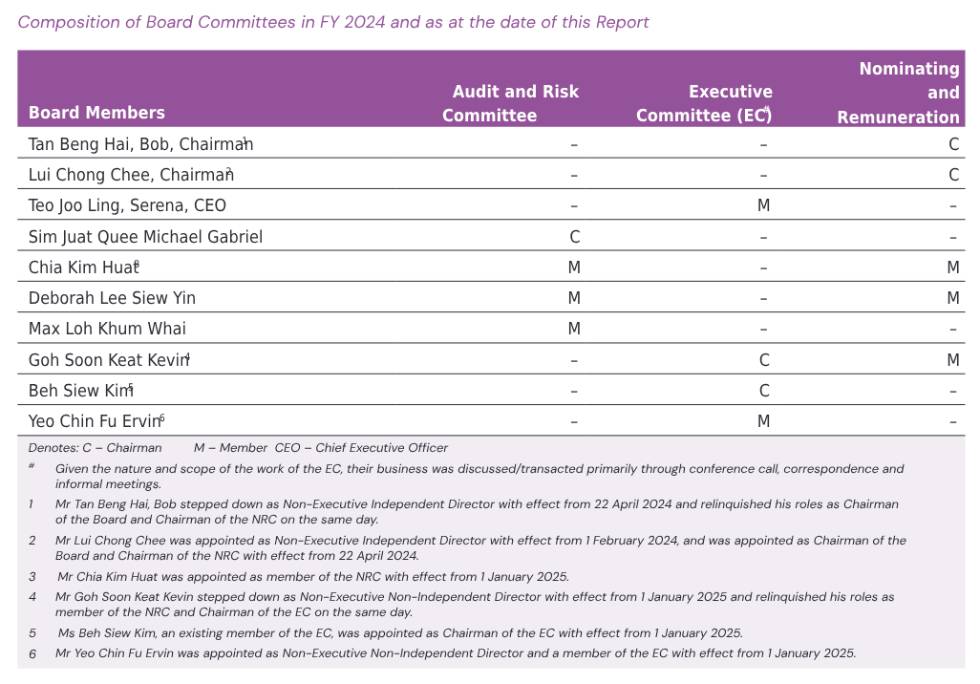

Board Committees

Each Board Committee has clear written terms of reference (setting out their composition, authorities and duties, including reporting back to the Boards) and operates under delegated authority from the Boards with the Boards retaining overall oversight. The decisions and significant matters discussed at Board Committee meetings are reported to the Boards on a periodic basis, and minutes of such meetings are also circulated to all members of the Boards. The composition of the various Board Committees in FY 2024 and as at the date of this Report is set out in the table on the next page.

Note:

2. The Boards consider all Board members’ views and feedback in recommending training and professional development programmes for the Boards and the Directors. Hence, any Director may recommend specific training and development programmes which he/she believes would benefit the Directors or the Boards. The review of training and professional development programmes is done by the Boards as a whole, and this function was not delegated to the NRC. While this is a partial deviation from Provision 4.1(c) which requires the NRC to review and make recommendations to the Boards on the training and professional development programmes for the Boards and their directors, this is consistent with the intent of Principle 4 of the Code.

Meetings of Board and Board Committees

Board and Board Committee meetings are scheduled prior to the start of each financial year. The constitutions of the Managers permit the Directors to participate via audio or video conference. The Boards and Board Committees may also make decisions by way of written resolutions.

The Boards may hold ad hoc meetings if required. The independent directors (IDs), led by the independent Chairman, also meet quarterly without the presence of Management. The Chairman provides feedback to the Boards and/or Management as appropriate.

There is active interaction between the Management and the Boards and Management provides updates to the Boards at Board meetings on the progress of CLAS’ business and operations (including market developments and trends, business initiatives, budget and capital management) and issues and challenges CLAS faces. The Directors and Management have separate, independent and unfettered access to each other at all times for any information they may require.

Management provides the Board with complete, adequate and timely information prior to Board and Board Committee meetings and on an ongoing basis, to enable the Directors to make informed decisions, discharge their duties and responsibilities, and facilitate focused discussions and active participation.

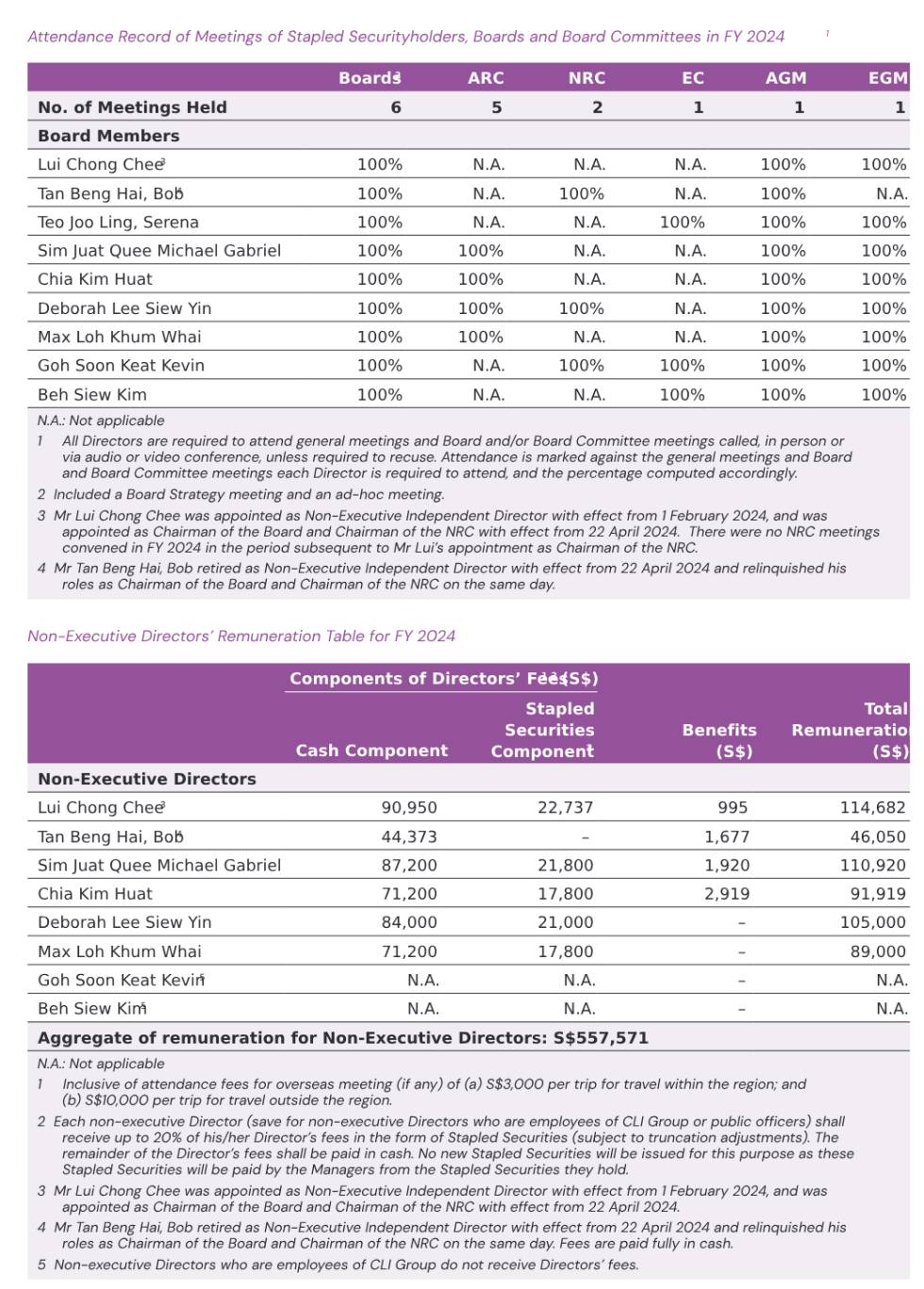

In FY 2024, the Boards held six meetings. The number of Board Committee meetings and Directors’ meeting attendance record for FY 2024 are set out on page 92 of this Annual Report. At Board and Board Committee meetings, all Directors actively participate in discussions, engaging in open and constructive debate and challenging Management on its assumptions and recommendations. No individual Director influences or dominates the decision-making process.

The Directors also have separate and independent access to the company secretary of the Managers (Company Secretary). The Company Secretary has oversight of corporate secretarial matters, ensuring that Board procedures are followed at Board meetings and facilitating the administration work relating to Directors’ professional development. The appointment and removal of the Company Secretary is subject to the Boards’ approval.

The Directors are entitled to access independent professional advice where required, at the Managers’ expense.

Principle 2: Board Composition and Guidance

Board Independence

The Boards have a strong independent element as five out of eight directors, including the Chairman, are non-executive IDs3. Other than the CEO, non-executive Directors make up the rest of the Boards. None of the Directors have served on the Boards for nine years or longer. No lead ID is appointed as the Chairman is an ID. Profiles of the Directors and their roles are set out on pages 11 to 13 of this Annual Report. The statement on the Composition of the Board of Directors of the TrusteeManager pursuant to Regulation 12(8) of the BTR can be found on pages 97 to 98 of this Annual Report.

The Boards, through the NRC, review the size and composition of the Boards and Board Committees regularly to ensure that they are appropriate to support effective deliberations and decision-making, and the composition reflects a strong independent element and diversity of thought and background. The review takes into account the scope and nature of CLAS’ operations, external environment and competition.

The Boards, with the recommendation of the NRC, assess annually (and when circumstances require) the independence of each Director in accordance with the requirements of the Listing Manual and the Code (including where relevant, the recommendations in the accompanying Practice Guidance (Practice Guidance)), the Securities and Futures (Licensing and Conduct of Business) Regulations (SFR) and the BTR. Under the Code, a Director is considered independent if he/she is independent in conduct, character and judgement, has no relationship with the Managers, their related corporations, their substantial shareholders, CLAS’ substantial Stapled Securityholders (being Stapled Securityholders who have interests in voting Stapled Securities of 5% or more of the total votes attached to all voting Stapled Securities) or the Managers’ officers, that could interfere, or be reasonably perceived to interfere with the exercise of his/her independent business judgement in CLAS’ best interests4

There is a rigorous process to evaluate the independence of each ID. As part of the process:

- each ID discloses his/her business interests and confirms annually that there are no relationships which interfere with the exercise of his/her independent business judgement in the Stapled Securityholders’ best interests, and such information is then reviewed by the NRC; and

- the NRC also considers the IDs’ conduct and contributions at Board and Board Committee meetings, in particular, whether he/she has exercised independent judgement in discharging his/her duties.

Thereafter, the NRC’s recommendation is presented to the Boards for their approval. IDs must recuse themselves from the NRC’s and the Boards’ deliberations on their own independence. The NRC also reviews the independence of an ID when there is a change in their circumstances and makes recommendations to the Boards. IDs are required to report to the Managers any changes which may affect their independence.

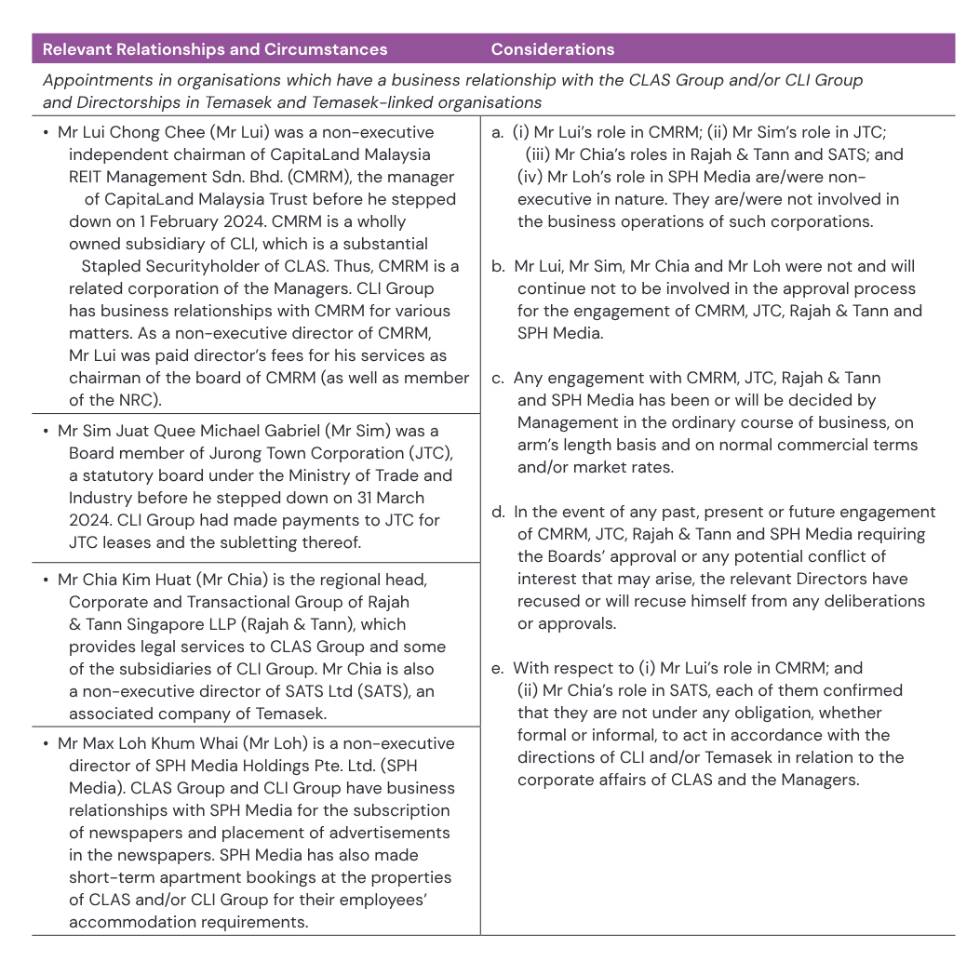

The outcome of the Boards’ assessment of the independence of the IDs as at the last day of FY 2024 is set out below.

In reviewing the IDs’ independence, the NRC considered the relevant relationships and circumstances of each ID, including those specified in the Listing Manual, the SFR and the Code. These include: (a) appointments in organisations which have a business relationship with the CLAS Group and/or the CLI Group, and (b) directorships in Temasek Holdings (Private) Limited (Temasek), the substantial Stapled Securityholder of CLAS through its indirect interest in CLI, and in organisations linked to Temasek. All IDs had recused themselves from the NRC’s and the Boards’ deliberations on their own independence.

Note:

3. As at 31 December 2024 and as at the date of this Report.

4. Under the Listing Manual, a director will not be considered independent under the following circumstances: (i) if he/she is or has been employed by the Managers or CLAS or any of their related corporations in the current or any of the past 3 financial years; (ii) if he/she has an immediate family member who is or has been employed by the Managers or CLAS or any of their related corporations in the current or any of the past 3 financial years, and whose remuneration is or was determined by the Boards and/or NRC; or (iii) if he/she has been a director of the Managers for an aggregate period of more than 9 years (whether before or after listing) in which case, such director may continue to be considered independent until the conclusion of the next annual general meeting of CLAS.

The Boards have considered the conduct of each of Mr Lui, Mr Sim, Mr Chia and Mr Loh and are of the view that the relationships above did not interfere with the exercise of independent judgement in the discharge of their duties and responsibilities as a Director. Ms Deborah Lee Siew Yin (Ms Lee) does not have any relationships and is not faced with any of the circumstances identified in the Code, SFR, BTR and Listing Manual, or other relationships which may affect her independent judgement. The Boards are of the view that these Directors have exercised independent judgment in the discharge of their duties and responsibilities. The Boards therefore determined that Mr Lui, Mr Sim, Mr Chia, Ms Lee and Mr Loh are independent Directors.

The Boards are of the view that as at the last day of FY 2024, each of Mr Lui, Mr Sim, Mr Chia, Ms Lee and Mr Loh was able to act in the Stapled Securityholders’ best interests in respect of the period in which they served as Directors in FY 2024.

In addition, under Regulation 13H(1) of the SFR, where a substantial shareholder of a manager of a real estate investment trust (REIT) is a corporation, a person would be considered to be connected to that substantial shareholder if he is, inter alia, a director of the substantial shareholder or a director of a related corporation or an associated company of the substantial shareholder. Such person will prima facie not be deemed to be independent unless the directors nevertheless regard him to be independent.

The Trustee-Manager is a related corporation of the REIT Manager as both the Trustee-Manager and the REIT Manager are directly held by CLI Group and as CapitaLand Ascott BT and CapitaLand Ascott REIT are stapled, the directors of the Managers are identical to avoid any differences or deadlock in the operation of the Stapled Group. As a result, all independent directors of the REIT Manager, namely Mr Lui, Mr Sim, Mr Chia, Ms Lee and Mr Loh will prima facie be deemed to be connected to a substantial shareholder of the REIT Manager and hence not independent pursuant to Regulation 13H of the SFR.

Against the foregoing, the board of directors of the REIT Manager (REIT Manager Board) has reviewed and assessed the independence of each of the IDs of the REIT Manager in relation to Regulation 13H of the SFR and has pursuant to Regulation 13D(8) of the SFR, resolved that notwithstanding that each of the IDs is a director of both the REIT Manager and the Trustee-Manager, the REIT Manager Board is satisfied that the IDs’ independent judgement and ability to act with regard to the interests of all the Stapled Securityholders of CLAS as a whole will not be impaired, on the basis that:

- for so long as CapitaLand Ascott BT is stapled to CapitaLand Ascott REIT, there will be no real prejudice to the interests of the holders of CapitaLand Ascott REIT Units for the Trustee-Manager and the REIT Manager to have the same board of directors as CapitaLand Ascott REIT Units and the CapitaLand Ascott BT Units will be stapled together and held by the same investors. The stapling together of CapitaLand Ascott REIT Units and CapitaLand Ascott BT Units means that the holders of CapitaLand Ascott REIT Units are at the same time the investors of the Stapled Securities, who stand to benefit as a whole; and

- since the CapitaLand Ascott BT Units and CapitaLand Ascott REIT Units are held by the same pool of investors in the same proportion, concerns and potential abuses applicable to interested party transactions will be absent in transactions between CapitaLand Ascott REIT and CapitaLand Ascott BT.

The remaining non-executive Directors, namely Ms Beh Siew Kim and Mr Yeo Chin Fu Ervin, are employees of CLI Group and are not considered to be independent.

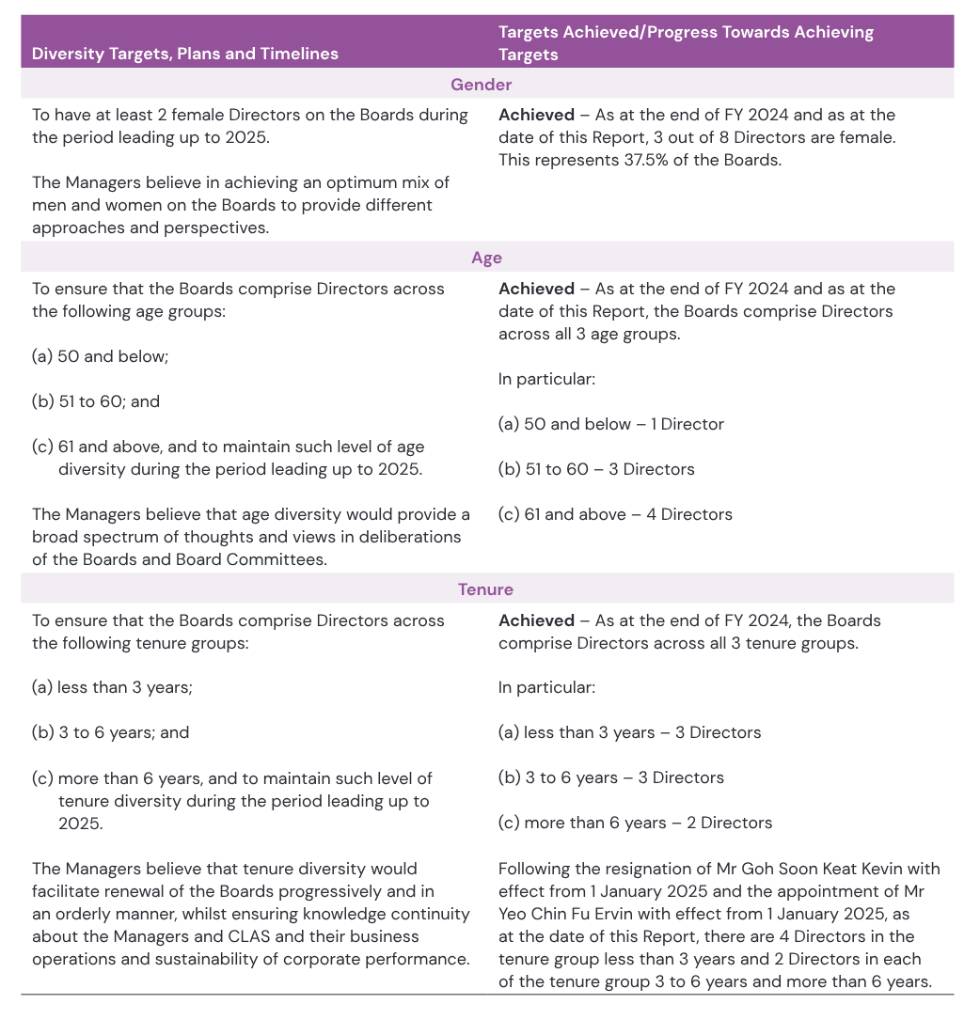

Board Diversity

The Boards embrace diversity and have a Board Diversity Policy which provides for the Boards to comprise talented and dedicated Directors with a diverse mix of expertise, experience, perspectives, skills and backgrounds, with due consideration to diversity factors, including diversity in age and gender.

The Boards value the benefits that diversity can bring to the Boards in their deliberations by enhancing decisionmaking capacity, avoiding groupthink and fostering constructive debate, which contributes to the effective governance of CLAS’ business and long-term sustainable growth.

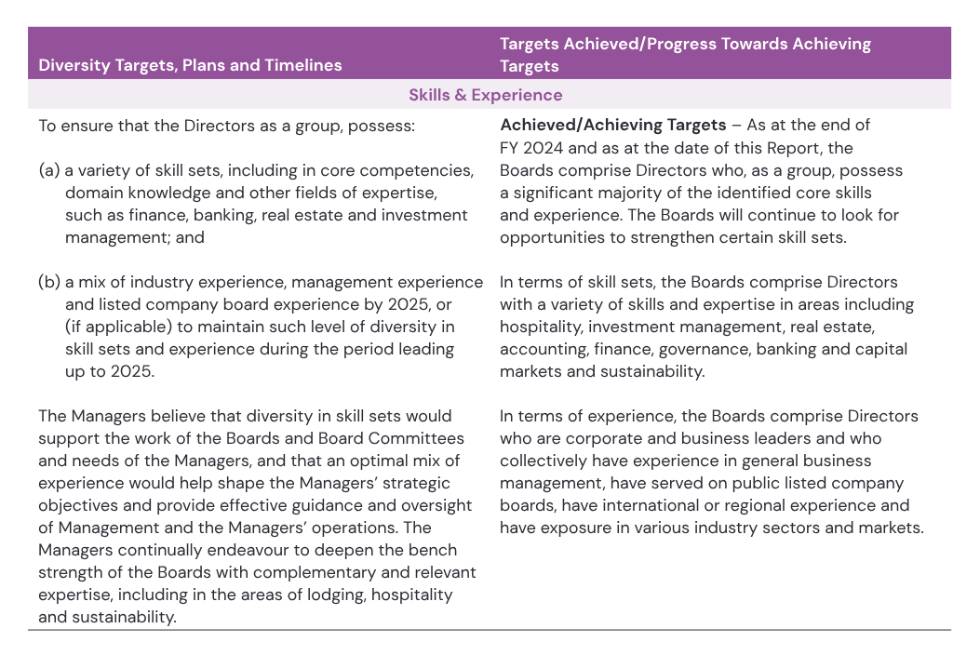

CLAS’ Board diversity targets, plans and timelines for achieving those targets are described on the next page.

Gender diversity is also considered an important aspect of diversity. The current Boards have three female members, one of whom is also the CEO, and the female representation on the Boards is 37.5%. It is noted that the Council for Board Diversity has a target of women making up 25% of the boards of SGX-ST listed companies by 2025.

The NRC has reviewed the size and composition of the Boards and their committees and is of the opinion that the current size is appropriate with an appropriate balance and diversity of skills, knowledge, talents, experience and backgrounds, taking into account the objectives of the Board Diversity Policy and CLAS’ business needs and plans, for effective decision-making and constructive debate.

For further information on the Boards’ work in this regard, please refer to “Board Membership” under Principle 4 in this Report.

Principle 3: Chairman and Chief Executive Officer

The roles of the Chairman and the CEO are held by separate individuals to ensure a clear division of responsibilities between the leadership of the Boards and Management, such that no individual has unfettered powers of decision-making. The Chairman does not share any family ties with the CEO.

The Chairman leads the Boards and plays a pivotal role in promoting open and constructive engagement among the Directors as well as between the Boards and Management at meetings.

The Chairman also presides at general meetings of Stapled Securityholders where he fosters constructive dialogue between the Stapled Securityholders, the Boards and Management.

The Chairman provides oversight to the CEO, who has full executive responsibilities to manage the Stapled Group’s business and to develop and implement policies approved by the Boards.

The separation of the responsibilities of the Chairman and CEO and the resulting clarity of roles facilitate robust deliberations on CLAS’ business activities and ensure an appropriate balance of power, increased accountability and greater capacity of the Boards for independent decision-making.

As the roles of the Chairman and the CEO are held by separate individuals who are unrelated, and the Chairman is an ID, no lead ID has been appointed. Moreover, the Boards have a strong independent element as five out of eight directors (including the Chairman) are nonexecutive IDs.

Principle 4: Board Membership

The Boards have a formal and transparent process for the appointment and re-appointment of Directors, taking into account the need for progressive renewal of the Boards. The NRC makes recommendations to the Boards on all appointments to the Boards and Board Committees. All Board appointments are made based on merit and subject to the Boards’ approval.

As at the date of this Report, the NRC comprises three non-executive Directors, all of whom (including the chairman of the NRC) are IDs. The three members on the NRC are Mr Lui Chong Chee (NRC Chairman), Mr Chia Kim Huat5 and Ms Deborah Lee Siew Yin.

The NRC met twice in FY 2024.

Under its terms of reference, the NRC’s scope of duties and responsibilities includes the following:

- review and make recommendations to the Boards on the Board size and composition, succession plans for Directors and composition of the Board Committees;

- review and recommend an objective process and criteria for evaluation of performance of the Boards, Board Committees and Directors;

- consider annually and when required, if a Director is independent; and

- consider and make recommendations to the Boards on the appointment and re-appointment of Directors (including alternate directors, if any)6.

Guided by its terms of reference, the NRC oversees the development and succession planning for the CEO. This includes overseeing the process for selection of the CEO and conducting an annual review of career development and succession matters for the CEO7

Note:

5. Mr Goh Soon Keat Kevin resigned as a Director and relinquished his role, and Mr Chia Kim Huat was appointed as NRC member, with effect from 1 January 2025.

6. For the avoidance of doubt, there are no alternate directors appointed for FY 2024.

7. While this is a partial deviation from Provision 4.1(a) which requires the NRC to make recommendations to the Boards on relevant matters relating to the review of succession plans, in particular the appointment and/or replacement of KMP, the Boards are of the view that such matters could be considered either by the NRC or by the Boards as a whole given that the NRC and/or the Boards as a whole are kept abreast of relevant matters relating to the review of succession plans relating to KMP, in particular the appointment and/or replacement of KMP. This is accordingly consistent with the intent of Principle 4 of the Code.

Board Composition and Renewal

The NRC considers different time horizons for purposes of succession planning. The NRC evaluates the Boards’ competencies on a long-term basis and identifies competencies which may be further strengthened in the long term to achieve CLAS’ strategy and objectives. As part of medium-term planning, the NRC seeks to refresh the membership of the Boards progressively and in an orderly manner, whilst ensuring continuity and sustainability of corporate performance. The NRC also considers contingency planning to prepare for sudden and unforeseen changes. In reviewing succession plans, the NRC has in mind CLAS’ strategic priorities and the factors affecting the long-term success of CLAS. The NRC aims to maintain the optimal composition of the Boards by considering the trends affecting CLAS, reviewing the skills needed and identifying gaps, including considering whether there is an appropriate level of diversity of thought. The process ensures that the Boards have capabilities and experience which align with CLAS’ strategy and the operating environment, and includes the following considerations: (a) the current size of the Boards and Board Committees, composition mix and core competencies; (b) the candidate’s/Director’s independence, in the case of an independent director; (c) the composition requirements for the Boards and relevant Board Committees (if the candidate/Director is proposed to be appointed to any Board Committee); and (d) the candidate’s/Director’s age, gender, track record, experience and capabilities and such other relevant factors as may be determined by the Boards, which would provide an appropriate balance and contribute to the collective skill of the Boards.

The Boards support continuous renewal for good governance, and have guidelines which provide for IDs’ tenure of no more than a maximum of two three-year terms, with any extension of tenure beyond six years to be reviewed on a yearly basis up to a period of nine years (inclusive of the initial two three-year terms served) by the NRC. Board succession planning is part of the NRC’s annual review of the Boards’ composition as well as when a Director gives notice of his/her intention to retire or resign. The annual review takes into account, among others, the requirements in the Listing Manual and the Code, feedback from any Board member and the diversity targets and factors in the Board Diversity Policy. The outcome is reported to the Boards. The Boards strive for orderly succession and continually look to fill future gaps in competencies and to renew the Boards in a progressive manner, whilst ensuring continuity and sustainability of corporate performance.

In the NRC’s selection of directors, searches for possible candidates are conducted through contacts and recommendations. External consultants may be retained to ensure a diverse slate of candidates.

Candidates are identified based on CLAS’ needs, taking into account skills required and the requirements in the Listing Manual and the Code, and assessed against a range of criteria including their demonstrated business sense and judgement, skills and expertise, and market and industry knowledge (and may include financial, sustainability or other competency, geographical representation and business background) with due consideration to diversity factors in the Board Diversity Policy. The NRC also considers the candidates’ alignment with CLAS’ strategic directions and values, ability to commit time and potential to complement the expertise and experience of the existing members of the Boards, as well as any qualitative feedback from Directors and Management from its annual Board evaluation exercise. The NRC uses a skills matrix to determine the skills gaps of the Boards and if the expertise and experience of a candidate would complement those of the existing Board members.

Board Changes

As part of the Boards’ renewal process, Mr Tan Beng Hai, Bob and Mr Goh Soon Keat Kevin stepped down from the Boards with effect from 22 April 2024 and 1 January 2025 respectively while Mr Lui Chong Chee and Mr Yeo Chin Fu Ervin were appointed on 1 February 2024 and 1 January 2025 respectively. Mr Lui Chong Chee took over the role of the Chairman with effect from 22 April 2024, following the retirement of Mr Tan Beng Hai, Bob.

Directors who are appointed to the Boards from time to time either have prior experience as a director of an issuer listed on the SGX-ST or will undergo further training required under Rule 210(5)(a) of the Listing Manual. Mr Yeo Chin Fu Ervin, being a first-time director, is or will be undergoing the requisite training under Rule 210(5)(a) of the Listing Manual before 31 December 2025 (being one year from the date of his appointment to the Boards). As at the date of this Report, Mr Yeo Chin Fu Ervin will be attending all of the relevant modules under the Listed Entity Directors (LED) Programme conducted by the Singapore Institute of Directors. Arrangements have been made for Mr Yeo Chin Fu Ervin to attend training in order to meet the mandatory training requirements under Practice Note 2.3 of the Listing Manual, with the target date of completion being June 2025.

Review of Directors' Ability to Commit Time

Directors must be able to devote sufficient time and attention to adequately perform their duties. The NRC reviews each Director’s appointments and commitments annually, and when there are changes which may affect their ability to commit time to the affairs of the Managers. Directors are required to report to the Boards any changes in their other appointments or commitments.

For the Directors’ other appointments and commitments, no limit is set as to the number of listed company board appointments. The Boards take the view that the number of listed company directorships that an individual may hold should be considered on a case-by-case basis, as a person’s available time and attention may depend on factors, such as his/her capacity, employment status, and the nature of his/her other responsibilities. IDs are required to inform the Chairman before accepting any new directorships or offer of full-time executive appointments.

Each Director is required to make a self-assessment and confirm that he/she is able to devote sufficient time and attention to the affairs of the Managers. For FY 2024, all non-executive Directors had undergone the self-assessment and provided confirmation.

In assessing each Director’s ability to commit time, the NRC takes into consideration each Director’s confirmation, his/her commitments, as well as attendance record and conduct and contributions (including preparedness, participation and level of engagement) at Board and Board Committee meetings. The Directors’ listed company directorships and other principal commitments are disclosed on pages 11 to 13 of this Annual Report. There is no alternate director to any of the Directors, which is in line with the principle adopted by the NRC that it will generally not approve the appointment of alternate directors.

Directors are informed of the expectation to attend scheduled meetings, unless unusual circumstances make attendance impractical or if a Director has to recuse himself/herself from the discussion. For FY 2024, the Directors achieved 100% attendance at all meetings. Based on the above, the NRC (with each member recused from deliberations in respect of himself/herself) has determined that each Director has been adequately carrying out his/her duties as a Director and noted that no Director has a significant number of listed directorships and principal commitments.

The Boards, taking into consideration the NRC’s assessment, have noted that each Director has been adequately carrying out his/her duties and responsibilities as a Director.

Principle 5: Board Performance

The Managers believe that regular self-assessment and evaluation of Board performance enables the Boards to reflect on their effectiveness, including the quality of their decisions, and for Directors to consider their performance and contributions. The process helps identify key strengths and areas for improvement which are essential for the effective stewardship of CLAS.

The NRC recommends for the Boards’ approval the objective performance criteria and evaluation process, and the Boards undertake, with the assistance of the Company Secretary, an annual formal assessment of the effectiveness of the Boards, Board Committees and individual Directors. As part of the appraisal process, a questionnaire is sent to the Directors. Management also provides feedback on areas including Board structure, strategy, performance and governance, as well as Board functions and practices. The results are aggregated and reported to the NRC, and thereafter the Boards. The findings are considered by the Boards and follow up action is taken where necessary. No external facilitators were appointed to assist in the evaluation process of the Boards and Board Committees for FY 2024.

Board and Board Committees

The evaluation categories covered in the questionnaire include Board composition, Board processes, strategy, performance and governance, access to information and Board Committee effectiveness. The Boards also consider whether the creation of value for Stapled Securityholders has been taken into account in the decision-making process. For FY 2024, the outcome of the evaluation was satisfactory and the Boards as a whole, and each of the Board Committees, received affirmative ratings across all the evaluation categories.

Individual Directors

The evaluation categories covered in the questionnaire include Director’s duties, contributions, conduct and interpersonal skills, as well as strategic thinking and risk management. For FY 2024, the outcome of the evaluation was satisfactory and each Director received affirmative ratings across all the evaluation categories.

The Boards believe that performance evaluation should be an ongoing process and seek feedback on a regular basis. The regular interactions between the Directors, and between the Directors and Management, also contribute to this ongoing process. Through such engagement, the Boards benefit from an understanding of shared norms between Directors which contributes to a positive Board culture.

Remuneration Matters

Principles 6, 7 and 8: Procedures for Developing Remuneration Policies, Level and Mix of Remuneration and Disclosure on Remuneration

All fees and remuneration payable to Directors, key management personnel (including the CEO) and staff of the Managers are paid by the Managers.

The Boards, assisted by the NRC, have a formal and transparent procedure for developing policies on Director and executive remuneration to the Boards for shareholders’ approval, as well as determining the remuneration of key management personnel (KMP).

As at the date of this Report, all NRC members are non-executive Directors, all of whom (including the NRC chairman) are independent Directors. Under the NRC’s terms of reference, its key responsibilities are:

- to oversee the Managers’ leadership development and succession planning for the CEO. The NRC oversees the process for selection of the CEO and reviews annually the career development and succession matters for the CEO. The Managers are committed to developing a strong talent pipeline to sustain its business growth, leveraging on the Sponsor’s established talent identification and succession processes. The NRC decides on the appointment of the CEO; and

- to review and recommend to the Boards, remuneration frameworks for the Boards and KMP; including reviewing the specific remuneration package for each Director as well as for the KMP; and the administration of the Managers’ Stapled Security Plans. The Boards set the remuneration policies to support the Stapled Group’s business strategy and deliver sustainable returns to Stapled Securityholders. In its deliberations, the NRC also takes into consideration industry practices and norms in compensation to ensure market competitiveness.

The NRC considers all aspects of remuneration, including termination terms, to ensure they are fair, and has access to remuneration consultants for advice on remuneration matters as required. It approves the specific remuneration package for each KMP (including the CEO), and recommends to the Boards for endorsement on the specific remuneration package for each Director.

While Provision 6.1 of the Code provides for the NRC to make recommendations to the Boards on the specific remuneration package for each KMP, the Boards are of the view that such matters are best decided by the NRC as part of its focused scope, and have delegated the decision-making on such matters to the NRC. The NRC reports any decisions made on such matters to the Boards. This is accordingly consistent with the intent of Principle 6 of the Code.

In FY 2024, the NRC appointed an independent remuneration consultant, Willis Towers Watson, to provide professional advice on Board and executive remuneration. The appointed independent remuneration consultant advises the NRC on the compensation of the KMPs including, but not limited to, the reasonableness of compensation levels in relation to the performance achieved, the competitiveness of compensation levels against relevant industry peers, compensation trends and practices around the world. The consultant is not related to the Managers, the Directors, their controlling shareholder or its directors or CLI’s related corporations.

Remuneration Policy for Key Management Personnel

The remuneration policy and framework, which take reference from the compensation framework of CLI, are designed to support the implementation of the Stapled Group’s strategy and deliver sustainable returns to Stapled Securityholders.

The Managers are subsidiaries of CLI which also hold a significant stake in CLAS. This association facilitates the Managers in attracting and retaining better qualified management talent. It further provides an intangible benefit to the employees of the Managers by offering the depth and breadth of experience associated with an established corporate group and enhanced career development opportunities.

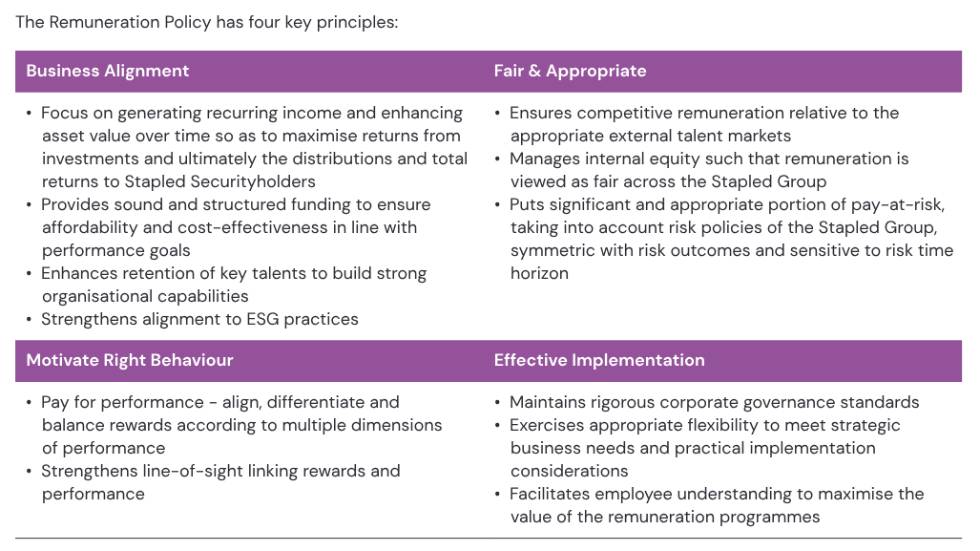

The Remuneration Policy has four key principles:

Under the Remuneration Framework, a significant proportion of the KMP’s, including the CEO’s, total remuneration is in the form of variable compensation, awarded in a combination of short-term, deferred and long-term incentives, to ensure alignment of the CEO’s and KMP’s interests with those of the Stapled Securityholders with an emphasis on linking pay to business and individual performance. Performance targets are hence set at realistic yet stretched levels each year to motivate a high degree of business performance with emphasis on both shorter-term and longer-term quantifiable objectives. There are four key components of the remuneration for the CEO and KMP:

A. Salary:

Includes the base salary, fixed allowances and compulsory employer contribution to an employee’s Central Provident Fund. The base salary is remunerated based on an employee’s competencies, experience, responsibilities and performance. It is typically reviewed on an annual basis to ensure market competitiveness.

B. Performance Bonus:

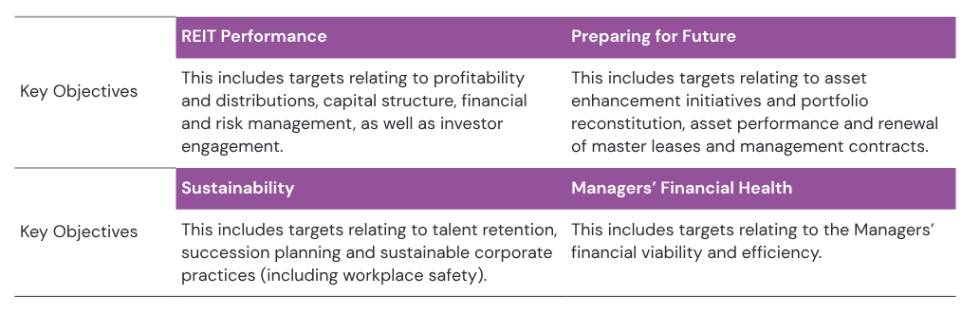

Using the Balanced Scorecard (BSC) framework, the Stapled Group’s strategies and goals are translated to performance outcomes comprising both quantitative and qualitative targets in the dimensions of REIT Performance, Preparing for Future, Sustainability and Managers’ Financial Health. These BSC targets are approved by the Boards and cascaded down throughout the organisation, thereby creating alignment across the Stapled Group. The performance measures and their relative weights in each dimension are reviewed annually to reflect the Stapled Group’s business priorities and focus for the relevant year.

After the close of each financial year, the Boards review the Stapled Group’s achievements against the BSC targets and determine the overall performance taking into consideration qualitative factors such as the quality of earnings, operating environment, regulatory landscape and industry trends.

In determining the payout quantum for each KMP, the NRC considers the overall business and individual performance, as well as the affordability of the payout to the Managers.

The Performance Bonus is paid out in the form of a cash bonus and deferred Stapled Securities awards with senior management grade employees receiving a greater proportion of their payout in deferred Stapled Securities. Deferred Stapled Securities awards are awarded pursuant to the Managers’ Restricted Stapled Security Plan (RSSP) and vests in three equal annual tranches without further performance conditions. Recipients will receive fully paid Stapled Securities, their equivalent cash value or combinations thereof. These Stapled Securities awards ensure ongoing alignment between remuneration and sustainable business performance.

C. Long-term Incentives:

The Managers have established the Performance Stapled Security Plan (PSSP) and RSSP (together, the Stapled Security Plans) to promote the alignment of Management’s interests with that of the Stapled Securityholders and CLAS’ long-term growth and value. The obligation to deliver the Stapled Securities is satisfied out of existing Stapled Securities held by the Managers.

The NRC has approved Stapled Security ownership guidelines for senior management to instill stronger identification with the long-term performance and growth of the Stapled Group. Under these guidelines, senior management are required to retain a prescribed proportion of Stapled Securities received under the Stapled Security Plans worth up to at least one year of basic salary. Stapled Securities vested pursuant to the Stapled Security Plans may be clawed back or reclaimed in circumstances where the relevant participants are found to be involved in financial misstatement, misconduct, fraud or malfeasance to the detriment of the Stapled Group.

Managers’ Performance Stapled Security Plan (PSSP)

Pursuant to the PSSP, Stapled Securities are awarded to senior management which are conditional on the achievement of targets relating to the following key measurements of wealth creation for Stapled Securityholders and commitment of the Stapled Group towards sustainability:

- Returns: Relative Total Stapled Securityholder Return (TSSR) of CLAS which is based on the percentile ranking of the TSSR of CLAS relative to the constituent REITs in the FTSE ST REIT Index;

- Portfolio Growth: Net Asset Value per Stapled Security; and

- Sustainability: Performance outcomes such as green building certification

The final number of PSSP Stapled Securities to be released will depend on the achievement of pre-determined targets over a three-year qualifying performance period. This serves to align Management’s interests with that of Stapled Securityholders in the longer term and to deter short-term risk taking. No Stapled Security will be released if the threshold targets are not met at the end of the qualifying performance period. If superior targets are met or exceeded, more Stapled Securities than the baseline award can be delivered up to a maximum of 200% of the baseline award. The NRC has the discretion to adjust the number of Stapled Securities released taking into consideration other relevant quantitative and qualitative factors. Recipients will receive fully paid Stapled Securities, their equivalent cash value or combinations thereof.

For FY 2024, the relevant award for assessment is the performance achieved by the Stapled Group for the award granted in FY 2022 where the qualifying performance period was FY 2022 to FY 2024. Based on the NRC’s assessment that the performance achieved by the Stapled Group has exceeded the pre-determined performance targets for such performance period, the resulting number of Stapled Securities for the finalised award has been adjusted accordingly to reflect the performance level.

In respect of the Stapled Securities awards granted pursuant to the PSSP in FY 2023 and FY 2024, the respective qualifying performance periods have not ended as at the date of this Report.

In FY 2021, a one-time Special CLI Founders Performance Share Plan (Special PSP Award) was granted by the CLI Group to selected senior executives within the group (including the Managers) to commemorate its listing, foster a “founders’ mindset” in driving transformation, and retain talent. The grant has a five-year performance period with defined performance parameters which are linked to CLI. Subject to the performance achieved, the award may vest at the end of the third and/or fifth year.

Such compensation is in the long-term interests of CLAS as CLAS is a key part of CLI’s business and ecosystem (and CLI is also the largest Stapled Securityholders of CLAS), and Management’s actions to grow CLAS and drive CLAS’ performance will also have a positive impact on CLI, thus reinforcing the complementary nature of the linked performance between CLAS and CLI. The cost of this one-time award will be borne by the Managers and it is not expected to form a significant part of the KMP’s remuneration over a five-year period. In addition, a proportion of the Management’s remuneration is paid in the form of Stapled Securities, which further incentivises the Management to take actions which are beneficial to the Stapled Securityholders. Accordingly, the Special PSP Award will not result in the Management prioritising the interest of CLI over that of CLAS given that the bulk of their remuneration is determined based on the evaluation of the performance of CLAS and a proportion of their remuneration comprises Stapled Securities. In addition, it should be further noted that under the SFA, the Managers and Directors of the Managers are required to act in the best interest of CLAS and give priority to the interest of CLAS over the interests of the shareholders of the Managers, and this would further mitigate any potential conflicts of interest. Save for the Special PSP Award, the NRC will continue to assess and reward the KMP based on the performance of CLAS. Accordingly, the Managers are of the view that there would not be any conflicts of interest arising from the arrangement, nor would the arrangement result in any misalignment of interest with those of Stapled Securityholders.

In respect of the Special PSP Award granted in FY 2021, the performance conditions required for interim vesting in the third year was partially met and CLI shares were released to the participants during the year. The next and final vesting, subject to performance conditions being met, will take place at the end of the qualifying performance period in 2026. There was no new Special PSP Award in FY 2024.

Managers’ Restricted Stapled Security Plan (RSSP)

Stapled Securities awarded pursuant to the RSSP may be conditional on pre-determined targets set for a one-year performance period. Prior to FY 2023, these targets were based on: (i) Profit After Tax and Minority Interests of the Stapled Group; and (ii) DPS of the Stapled Group. These performance measures were selected as they are the key drivers of business performance and are aligned to Stapled Securityholders’ value.

The final number of Stapled Securities to be released will depend on the Stapled Group’s performance against the targets at the end of the one-year qualifying performance period. The Stapled Securities will be released in equal annual tranches over a vesting period of 3 years. No Stapled Securities will be released if the threshold targets are not met at the end of the qualifying performance period. If superior targets are met or exceeded, more Stapled Securities than the RSSP baseline award can be delivered, up to a maximum of 150% of the baseline award. The NRC has the discretion to adjust the number of Stapled Securities released, taking into consideration other relevant quantitative and qualitative factors. Recipients will receive fully paid Stapled Securities, their equivalent cash value or combinations thereof.

Time-vested awards may also be granted pursuant to the RSSP in the form of:

- deferred Stapled Securities from the Performance Bonus and vest in three equal annual tranches without further performance conditions with the first tranche delivered in the same year as the year of award; or

- time-vested restricted awards for the retention of critical talents, or recruitment of new senior executive hires to compensate for the share-based incentives that they may have had to forgo when they left their previous employer to join the Managers. Such awards can vest progressively over periods of up to three years, provided recipients of the awards remain under employment of the CLI Group.

As part of the FY 2024 performance bonus, deferred Stapled Securities were awarded in FY 2025 pursuant to the RSSP, which will vest in three equal annual tranches without further performance conditions, with the first tranche to be delivered in FY 2025. In addition, timevested restricted awards pursuant to the RSSP were also granted to selected key executives. These awards will vest in two equal annual tranches without any further performance conditions, with the first tranche to be delivered in FY 2025. There were no performance-based awards granted pursuant to the RSSP in FY 2024.

D. Employee Benefits:

The benefits provided are comparable with local market practices.

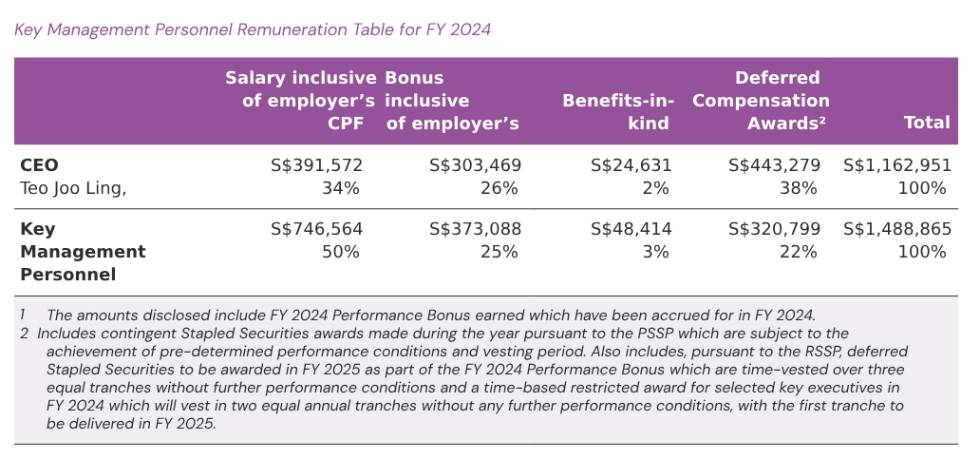

Remuneration of Key Management Personnel

Each year, the NRC evaluates the extent to which each of the KMP has delivered on the business and individual goals and objectives, and based on the outcome of the evaluation, approves the compensation for the KMP. In such evaluation, the NRC considers whether the level of remuneration is appropriate to attract, retain and motivate the KMP to successfully manage CLAS for the long term. The CEO does not attend discussions relating to her own performance and remuneration.

In determining the remuneration package for each KMP, the NRC takes into consideration appropriate compensation benchmarks within the industry, so as to ensure that the remuneration packages payable to KMP are competitive and in line with the objectives of the remuneration policies.

While the disclosure of, among others, the names, amounts and breakdown of remuneration of at least the top five KMP (who are not Directors or the CEO) in bands no wider than S$250,000 and the aggregate of the total remuneration paid to these KMP would be in full compliance with Provision 8.1 of the Code, the Boards have considered carefully and decided that such disclosure would not be in the interests of the Managers or Stapled Securityholders due to:

- the intense competition for talents in the REIT management industry, the Managers are of the view that it is in the interests of Stapled Securityholders to not make such disclosures so as to minimise potential staff movement and undue disruption to its key management team;

- the need to balance the confidential and commercial sensitivities associated with remuneration matters, the Managers are of the view that such disclosures could be prejudicial to the interests of Stapled Securityholders;

- the importance of retaining competent and experienced staff to ensure CLAS’ stability and continuity of business operations, the Managers are of the view that such disclosures may subject the Managers to undue risks, including unnecessary key management turnover; and

- there being no misalignment between the remuneration of the KMP and the interest of Stapled Securityholders. Their remuneration is not borne by CLAS as they are paid out from the fees that the Managers receive (the quantum and basis of which have been disclosed on page 80 of this Annual Report).

The Managers are of the view that disclosure of the total remuneration of the KMP for FY 2024 together with the breakdown of their remuneration in the manner set out on page 80 provides a more holistic view and is consistent with the intent of Principle 8 of the Code, and that these and other details in this Corporate Governance Report provide sufficient information and transparency to Stapled Securityholders on CLAS’ remuneration policies for KMP, including the level and mix of remuneration and the procedure for setting remuneration. These disclosures would enable Stapled Securityholders to understand the relationship between CLAS’ performance, value creation and the remuneration of KMP. The Managers are of the view that the interests of Stapled Securityholders are not prejudiced by the abovementioned deviation from Provision 8.1(b) of the Code, as the remuneration of KMP is aligned to safeguard these interests.

Apart from the KMP and other employees of the Managers, the Managers outsource various other services to a wholly owned subsidiary of CLI (CLI Subsidiary). The CLI Subsidiary provides these services through its employees and employees of CLI Group (together, the Outsourced Personnel). This arrangement is put in place so as to provide flexibility and maximise efficiency in resource management to match the needs of CLAS from time to time, as well as to leverage on economies of scale and tap on the management talent of an established corporate group which can offer enhanced depth and breadth of experience. Notwithstanding the outsourcing arrangement, the responsibility for due diligence, oversight and accountability continues to reside with the Boards and Management. In this regard, the remuneration of such Outsourced Personnel, being employees of the CLI Subsidiary and CLI Group, is not included as part of the disclosure of remuneration of KMP of the Managers in this Report.

In FY 2024, there were no termination, retirement or post-employment benefits granted to Directors, the CEO and other KMP. There was also no special retirement plan, ‘golden parachute’ or special severance package for any KMP.

There were also no employees of the Managers who were substantial shareholders of the Managers, substantial Stapled Securityholders of CLAS or immediate family members of a Director, the CEO, any substantial shareholder of the Managers or any substantial Stapled Securityholder of CLAS. “Immediate family member” refers to the spouse, child, adopted child, step-child, sibling or parent of the individual.

Remuneration Disclosures under AIFMR

The Managers are required under the AIFMR to make quantitative disclosures of remuneration. Disclosures are provided in relation to (a) the staff of the Managers; (b) staff who are senior management; and (c) staff who have the ability to materially affect the risk profile of CLAS.

All individuals included in the aggregated figures disclosed are rewarded in line with the Managers’ remuneration policies described in this Report.

The aggregate amount of remuneration awarded by the Managers to its staff (including CEO and non-executive Directors) in respect of FY 2024 was approximately S$4.83 million. This figure comprised fixed pay of S$2.67 million, variable pay of S$1.95 million (including Stapled Securities issued under the Stapled Security Plans, where applicable) and allowances and benefits-inkind of S$0.21 million. There were a total of 20 beneficiaries of the remuneration described above. In respect of FY 2024, the aggregate amount of remuneration awarded by the Managers to its senior management (which are also members of staff whose actions have a material impact on the risk profile of CLAS) was approximately S$2.82 million, comprising five individuals having considered, among others, their roles and decisionmaking powers.

Remuneration for Non-Executive Directors

The non-executive Directors’ fees are paid by the Managers and the FY 2024 fees, together with a breakdown of the components, are set out in the Non-Executive Directors’ Remuneration Table on page 92 of this Annual Report.

The remuneration policy for non-executive Directors is based on a scale of fees divided into basic retainer fees for serving as Director and additional fees for serving on Board Committees. There were no attendance fees payable, save for in-person participation by Directors at Board and Board Committee meetings that require Directors to travel overseas. Directors’ fees are paid to non-executive Directors on a current year basis.

The CEO, who is an executive Director, is remunerated as part of the Managers’ KMP and does not receive any Director’s fees. The non-executive Directors who are employees of the CLI Group also do not receive any Directors’ fees.

The non-executive Directors’ fee structure and Directors’ fees are reviewed and benchmarked against the REIT industry annually, taking into account the effort, time spent and responsibilities on the part of the nonexecutive Directors in light of the scale, complexity and geographic scope of the Stapled Group’s business. The remuneration of non-executive Directors is reviewed from time to time to ensure that it is appropriate to attract, retain and motivate the non-executive Directors to provide good stewardship of the Managers and CLAS. The non-executive Directors’ remuneration (including any Stapled Securities awards granted under the RSSP in lieu of cash) does not include any performancerelated elements. The framework for the non-executive Directors’ fees has remained unchanged from that of the previous financial year.

The non-executive Directors’ fees are paid in cash (about 80%) and in the form of Stapled Securities (about 20%), save that (i) a non-executive Director (not being an employee of the CLI Group) who steps down from the Boards during a financial year will be paid fees fully in cash. The Managers believe that the payment of a portion of the non-executive Directors’ fees in Stapled Securities will serve to align the interests of non-executive Directors with the interests of Stapled Securityholders and CLAS’ long-term growth and value. The payment of non-executive Directors’ fees in Stapled Securities is satisfied from the Stapled Securities held by the Managers. No individual Director is involved in any decision of the NRC relating to his/her own remuneration.

In order to encourage the alignment of the interests of the non-executive Directors with the interests of Stapled Securityholders, a non-executive Director is required to hold the number of Stapled Securities worth at least one year of the basic retainer fee or the total number of Stapled Securities awarded, whichever is lower, at all times during his/her Board tenure.

Accountability and Audit

Principle 9: Risk Management and Internal Controls

The Managers maintain adequate and effective systems of risk management and internal controls (including financial, operational, compliance, information technology (IT) and sanctions-related controls) to safeguard Stapled Securityholders’ interests and CLAS’ assets.

The Boards have overall responsibility for the governance of risk and oversee the Managers in the design, implementation and monitoring of the risk management and internal controls systems. The ARC assists the Boards in carrying out the Boards’ responsibility of overseeing the risk management framework and policies for CLAS and ensuring that Management maintains sound systems of risk management and internal controls.

Under its terms of reference, the scope of the ARC’s duties and responsibilities includes:

- making recommendations to the Boards on the Risk Appetite Statement (RAS) for CLAS and CLAS’ risk profile;

- assessing the adequacy and effectiveness of the risk management and internal controls systems established by the Managers to manage risks;

- overseeing the formulation, updating and maintenance of an adequate and effective risk management framework, policies and strategies for managing risks that are consistent with CLAS’ risk appetite and reports to the Boards on its decisions on any material matters concerning the aforementioned;

- making the necessary recommendations to the Boards such that an opinion regarding the adequacy and effectiveness of the risk management and internal controls systems can be made by the Boards in the Annual Report in accordance with the Listing Manual and the Code; and

- considering and advising on risk matters referred to it by the Boards or Management, including reviewing and reporting to the Boards on any material breaches of CLAS’ RAS, any material non-compliance with the approved framework and policies and the adequacy of any proposed action.

The Managers adopt an Enterprise Risk Management (ERM) Framework which sets out the required environmental and organisational components for managing risks in an integrated, systematic and consistent manner. The ERM Framework and related policies are reviewed annually.

As part of the ERM Framework, the Managers undertake and perform a Risk and Control Self-Assessment (RCSA) annually to identify material risks along with their mitigating measures. The adequacy and effectiveness of the systems of risk management and internal controls are reviewed at least annually, by Management, the ARC and the Boards, taking into account the best practices and guidance in the Risk Governance Guidance for Listed Boards issued by the Corporate Governance Council and the Listing Manual.

CLAS’ RAS, which incorporates CLAS’ limits, addresses the management of material risks faced by CLAS. Alignment of CLAS’ risk profile to CLAS’ RAS is achieved through various communication and monitoring mechanisms (including key risk indicators set for Management) put in place across the various functions within the Managers.

More information on the Managers’ ERM Framework including the material risks identified can be found in the Risk Management section on pages 58 to 62 of this Annual Report.

The internal and external auditors conduct reviews of the adequacy and effectiveness of the material internal controls (including financial, operational, compliance, IT and sanctions-related controls) and risk management systems. This includes testing, where practicable, material internal controls in areas managed by external service providers. Any material non-compliance or lapses in internal controls together with corrective measures recommended by the internal and external auditors are reported to and reviewed by the ARC. In the course of their statutory audit, the external auditors had considered the risk assessment conducted by the internal auditors. Any material non-compliance and weakness in internal controls, together with the internal auditors’ recommendations to address them, are reported to the ARC. The ARC also reviews the adequacy and effectiveness of the measures taken by the Managers on the recommendations made by the internal and external auditors in this respect.

The Boards have received assurance from the CEO and the Chief Financial Officer (CFO) of the Managers that the financial records of CLAS have been properly maintained and the financial statements for FY 2024 give a true and fair view of CLAS’ operations and finances. They have also received assurance from the CEO, the CFO and the relevant KMP who have responsibility regarding various aspects of risk management and internal controls that the systems of risk management and internal controls within CLAS are adequate and effective to address the risks (including financial, operational, compliance, IT and sanctions-related risks) that the Managers consider relevant and material to the current business environment.

The CEO, the CFO and the relevant KMP of the Managers have obtained similar assurances from the respective risk and control owners. In addition, for FY 2024, the Boards received half-yearly certification by Management on the integrity of financial reporting and the Boards provided a negative assurance confirmation to Stapled Securityholders as required by the Listing Manual.

Based on the ERM Framework established and the reviews conducted by Management and both the internal and external auditors, as well as the assurance from the CEO and the CFO, the Boards are of the opinion that the systems of risk management and internal controls (including financial, operational, compliance, IT and sanctions-related controls) are adequate and effective to address the risks (including financial, operational, compliance, IT and sanctions-related risks) which CLAS considers relevant and material to its current business environment as at 31 December 2024. The ARC concurs with the Boards in their opinion.

No material weaknesses in the systems of risk management and internal controls were identified by the Boards or the ARC in the review for FY 2024. The Boards note that the systems of risk management and internal controls established by the Managers provide reasonable assurance that CLAS, as it strives to achieve its business objectives, will not be significantly affected by any event that can be reasonably foreseen or anticipated. However, the Boards also note that no system of risk management and internal controls can provide absolute assurance in this regard, or absolute assurance against poor judgement in decision-making, human error, losses, fraud or other irregularities.

Principle 10: Audit and Risk Committee

The ARC comprises four non-executive Directors, all of whom (including the ARC chairman) are IDs. They bring recent and relevant managerial and professional expertise or experience in accounting, auditing and related financial management domains.

The ARC does not comprise former partners of the external auditors, Deloitte & Touche LLP (Deloitte) (a) within a period of two years commencing from the date of their ceasing to be partners of Deloitte; or (b) who have any financial interest in Deloitte.

The ARC has explicit authority to investigate matters within its terms of reference. Management gives the fullest co-operation in providing information and resources to the ARC, and carrying out its requests. The ARC has direct access to the internal and external auditors and full discretion to invite any Director or KMP to attend its meetings. Similarly, internal and external auditors have unrestricted access to the ARC.

Under its terms of reference, the ARC’s scope of duties and responsibilities includes:

- reviewing the significant financial reporting issues and judgements so as to ensure the integrity of the financial statements of the Stapled Group and any announcements relating to the Stapled Group’s financial performance;

- reviewing and reporting to the Boards at least annually the adequacy and effectiveness of the Managers’ internal controls (including financial, operational, compliance and IT controls) and risk management systems;

- reviewing the assurances from the Management (including the CEO and the CFO) on the financial records and financial statements;

- reviewing the adequacy, effectiveness, independence, scope and results of the internal audit and external audit, and the adequacy and effectiveness of the Managers’ internal audit function and the external auditors respectively;

- making recommendations to the Boards on the proposals to Stapled Securityholders on the appointment, re-appointment and removal of the external auditors, and approving remuneration and terms of engagement of the external auditors;

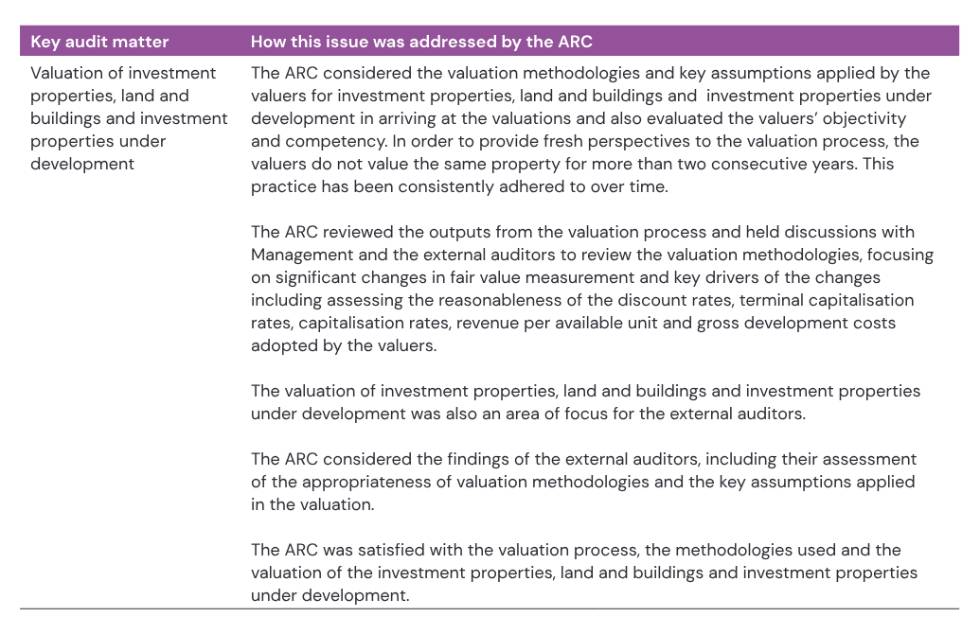

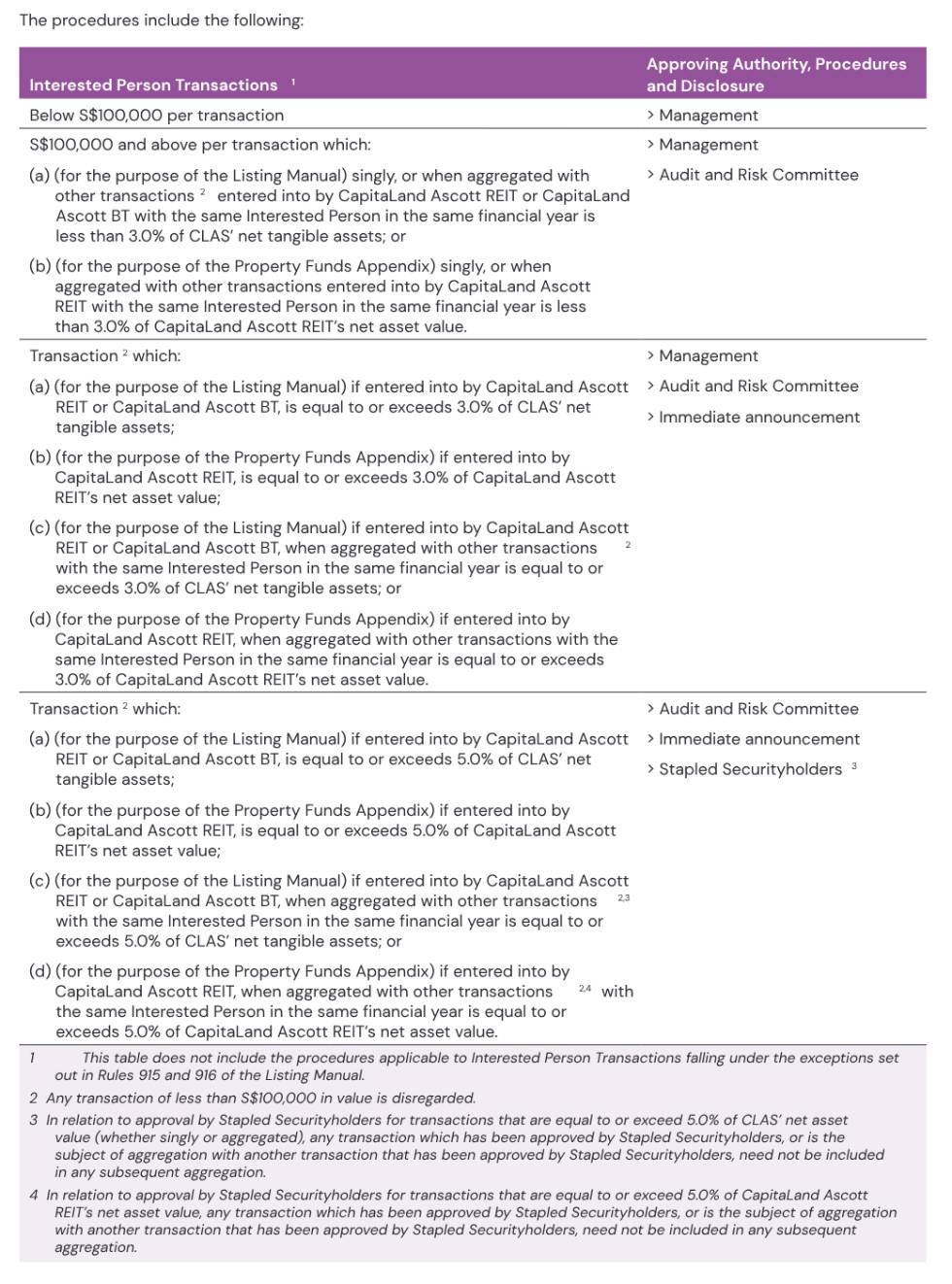

- reviewing and approving processes to regulate transactions between an interested person (as defined in Chapter 9 of the Listing Manual) and/or interested party (as defined in the Property Funds Appendix) (each, an Interested Person) and CLAS and/ or its subsidiaries (Interested Person Transactions), to ensure compliance with the applicable regulations. The regulations include the requirements that Interested Person Transactions are on normal commercial terms and are not prejudicial to the interests of CLAS and its minority Stapled Securityholders. In respect of any property management agreement which is an Interested Person Transaction, the ARC also carries out reviews at appropriate intervals to satisfy itself that the Managers have reviewed the property manager’s compliance with the terms of the property management agreement and has taken remedial actions where necessary; and

- reviewing the policy and arrangements for concerns about possible improprieties in financial reporting or other matters to be safely raised, and independently investigated, for appropriate follow up action to be taken.

The ARC reviewed the independence of the external auditors, considering the non-audit services provided, and is satisfied that the independence of the external auditors is not affected by the provision of such services. The external auditors have also provided confirmation of their independence to the ARC. The amount of audit and audit-related fees paid or payable to the external auditors for FY 2024 amounted to S$3,564,000. The external auditors did not provide any non-audit services in FY 2024.